Following The Money

Large cash transactions by marijuana businesses should not be automatically flagged as suspicious, as per the latest IRS guidance.

The tax agency’s guidance aims to provide clarity on the federal Bank Secrecy Act, which mandates businesses, including banks, to submit Form 8300 within 15 days if they receive $10,000 or more in cash.

Those forms enable the filer to categorize a transaction as “suspicious,” providing vital information for investigation by the IRS and the Financial Crimes Enforcement Network (FinCEN) into potential criminal activity.

But classifying a cash transaction from a legitimate cannabis enterprise as suspicious in a defensive manner is a misuse of that designation,” cautioned IRS Special Counsel Charles Hall in a memorandum dated January 22nd.

Links to the IRS Releases

Related Articles

Michigan House Bill Proposes 32% Tax on Internet Devices for Kids

Taxed Again..? They're working on it.A newly introduced Michigan House bill would impose a 32% excise tax on smartphones, tablets, gaming systems, and other internet‑connected devices marketed to or primarily used by minors. Lawmakers backing the proposal argue the...

Shadow cash is corrupting Michigan courtrooms

The Shadow Cash Threat: Protecting the Integrity of Michigan Courtrooms In recent months, a spotlight has been cast on a hidden influence within the Michigan legal system: "shadow cash." This term refers to third-party litigation funding (TPLF), where outside...

Michigan judge charged in stealing from incapacitated adults

No Good Headline to Lead with HereSummary Federal prosecutors have charged a 36th District Court judge and three associates with orchestrating a long‑running financial scheme that diverted funds from incapacitated adults under court‑appointed guardianship. The...

Michigan Cannabis Tax Fraud Cases Are Rising

Hands up CaponeMichigan’s regulated cannabis industry is in a very different place than it was when medical marijuana and adult-use legalization were the primary battlegrounds. As prices compress, margins disappear, and tax burdens increase, enforcement doesn’t...

More Posts

What is Inference Stacking?

What Is Inference Stacking? A Legal ExplanationInference stacking—also called pyramiding of inferences—is a rule of evidence that prohibits courts or juries from...

Deadlocked Jury – What does it mean?

A deadlocked jury is often called a hung jury—A deadlocked jury—often called a hung jury—occurs when jurors cannot reach the unanimous (or legally required) agreement...

The New Federal Definition of Hemp

The New Federal Definition of Hemp: Legal and Regulatory ImplicationsCongress has enacted a sweeping revision to the federal definition of hemp through the Continuing...

Miranda v Arizona

Case Summary Miranda v. Arizona established that before police conduct custodial interrogation, they must advise suspects of their rights: the right to remain silent,...

Your Voice, Your Rights: Understanding the First Amendment in Michigan

Freedom of Speech - The First Amendment This right is not really absoluteIn a world filled with diverse opinions and constant communication, knowing your fundamental...

Legal Tip – Driving High on Cannabis in Michigan

Driving under the influence of cannabis is illegal and carries serious consequences in Michigan.We have fought and won many cases from the District Courts, Circuit...

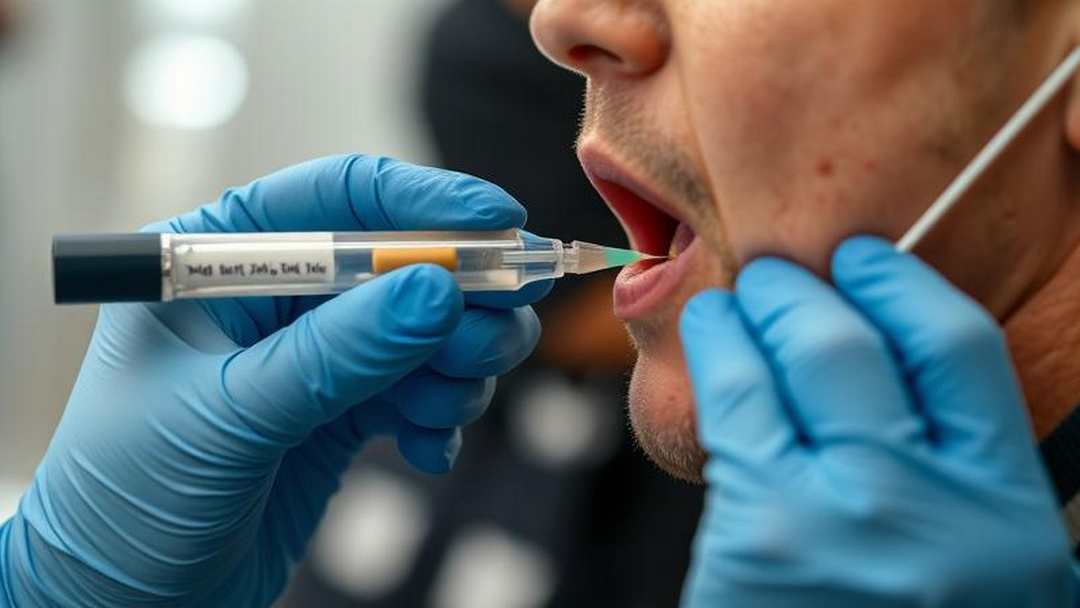

Michigan House Bill NO. 4391

It may just be easier to collect and analyze tears.This legislation seeks to integrate saliva testing for cannabis within law enforcement procedures, designating a...

Legal Tip – Your Rights During a DUI Stop in Michigan

Komorn Law - Quick Legal TipsLegal Tip: Understanding Your Rights During a DUI Stop in Michigan A DUI stop can be stressful, but knowing your rights is crucial. You...

Forfeiture without Criminal Charges

Can the police seize your belongings and hold it without charging you with a crime?Read the summary below and watch Attorney Michael Komorn in the Court of...

23andMe filed for Chapter 11 bankruptcy and your data is?

As of Friday 3/28/25, the firm’s shares were worth less than a dollar.If you are charged with a crime you're part of the State of Michigan family now. Call us - Because...