Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

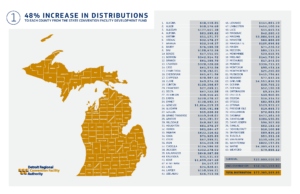

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

Michigan lawmakers want to revive “junk science” roadside drug testing

The Roadside Drug Test...AgainHouse bills 4390 and 4391The proposed House bills 4390 and 4391 would enable law enforcement to administer tests aimed at assessing driver impairment; however, these testing devices do not provide information regarding the level of...

Michigan Probationers Allowed Medical Marijuana

Yea. We did that...What it is supposed to beOn February 11, 2021, the Michigan Court of Appeals ruled that judges cannot prohibit individuals on probation from using medical marijuana if they are registered patients under the Michigan Medical Marihuana Act (MMMA)....

Public Defenders in Michigan – Qualifications and What They Do

Note: This is what they are supposed to do. Whether they give a damn about you and the outcome is up to the individual attorneyWhat it is supposed to beIn Michigan, public defenders play a vital role in the criminal justice system by providing legal representation to...

New Michigan Laws Going Into Effect 2025

Making laws as fast as possible. Look over here...Not over there.Some of Michigan's new laws in 2025 include minimum wage increases, paid sick time, and automatic voter registration. Minimum wage The minimum wage in Michigan increased to $10.56 per hour on January 1,...

More Posts

Legal Tip – Driving High on Cannabis in Michigan

Driving under the influence of cannabis is illegal and carries serious consequences in Michigan.We have fought and won many cases from the District Courts, Circuit Courts, Court of Appeals and the Supreme Court through out the State of Michigan. We have also fought...

Michigan House Bill NO. 4391

It may just be easier to collect and analyze tears.This legislation seeks to integrate saliva testing for cannabis within law enforcement procedures, designating a refusal to participate in this testing as a criminal offense, similar to the penalties imposed for...

Legal Tip – Your Rights During a DUI Stop in Michigan

Komorn Law - Quick Legal TipsLegal Tip: Understanding Your Rights During a DUI Stop in Michigan A DUI stop can be stressful, but knowing your rights is crucial. You have the right to remain silent. You are not obligated to answer questions beyond basic identification....

Forfeiture without Criminal Charges

Can the police seize your belongings and hold it without charging you with a crime?Read the summary below and watch Attorney Michael Komorn in the Court of Appeals.Summary of "Ruben Delgado v. Michigan State Police": This case was filed in the Jackson County Circuit...

23andMe filed for Chapter 11 bankruptcy and your data is?

As of Friday 3/28/25, the firm’s shares were worth less than a dollar.If you are charged with a crime you're part of the State of Michigan family now. Call us - Because you don't want to be a part of that family. Komorn Law (248) 357-2550Genetic testing service...

Judge finds marijuana testing facilities run by ex-cops violated testing results

Viridis Laboratories has faced ongoing allegations of exaggerating THC levels while minimizing the potential risks associated with cannabis.If you are charged with a crime you're part of the State of Michigan family now. Call us - Because you don't want to be a part...

Domestic Violence Conviction Prohibits Gun Ownership

No Second Amendment Rights For YouIf you are charged with a crime you're part of the State of Michigan family now. Call us - Because you don't want to be a part of that family. Komorn Law (248) 357-2550A federal judge in Michigan has ruled that a man with a prior...

Update on Michigan’s Sick Time Act (Small Business Compliance)

Small Business Compliance Accrual Method: Employees accrue 1 hour of paid sick time forevery 30 hours worked, and unused paid sick time rolls over upto 72 hours, or 40 for a small business. Employers may limit theuse of earned sick time to 72 hours, or 40 for a small...

What Are Your Rights Before And After Arrest?

What are your rights before and after arrest?Generally, police require a search warrant to lawfully enter any private premises or to search electronic devices such as your phone or computer. If the police do not possess a search warrant, you are under no obligation to...

Drones – What Drones? Update

Drone story update January 28, 2025 NJ drones 'were authorized to be flown by FAA for research,' Donald Trump says The mysterious drones that captivated New Jersey late last year were not enemy craft, but instead were authorized by the FAA, President Donald Trump said...