Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

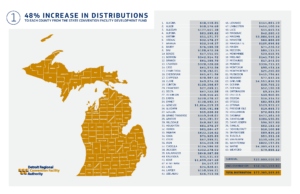

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

$87 million in adult-use marijuana payments to be sent out across Michigan

The Michigan Department of Treasury today announced that more than $87 million is being distributed among 269 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act. Over the next few days, 99 cities, 30 villages, 69 townships...

Protest about marijuana and tobacco sales to kids

Protest about marijuana and tobacco sales to kidsWatch the report here on Channel 7 WXYZ TV Detroit (who disabled the embedding feature)Related ArticlesMore Posts

Michigan: No Evidence of Widespread Discriminatory Policing Practices

No Evidence of Widespread Discriminatory Policing PracticesNever Ending Quest January 18, 2024 In the department’s continuing work to research and address racial disparities in traffic stops, independent consulting firm CNA has determined that racial disparities...

DEA – AG Miss Deadline to Respond on Cannabis Rescheduling

The Drug Enforcement Administration persists in maintaining secrecy around their process, disregarding a congressional request for transparency.Never Ending StoryThe Drug Enforcement Administration (DEA) and Attorney General Merrick Garland missed a Feb. 12 deadline...

More Posts

Cannabis cash transactions aren’t suspicious says IRS

Following The MoneyLarge cash transactions by marijuana businesses should not be automatically flagged as suspicious, as per the latest IRS guidance. The tax agency's guidance aims to provide clarity on the federal Bank Secrecy Act, which mandates businesses,...

An Independent Review of the Intoxilyzer 9000

An Independent Review of the Intoxilyzer 9000 Part 1 - Residual mouth alcohol detection Counterpoint Volume 2; Issue 2 - Article 3 (August 2017) An article in the Core Skills III-2 Module Jan Semenoff, BA, EMAForensic CriminalistThe opportunity to conduct an...

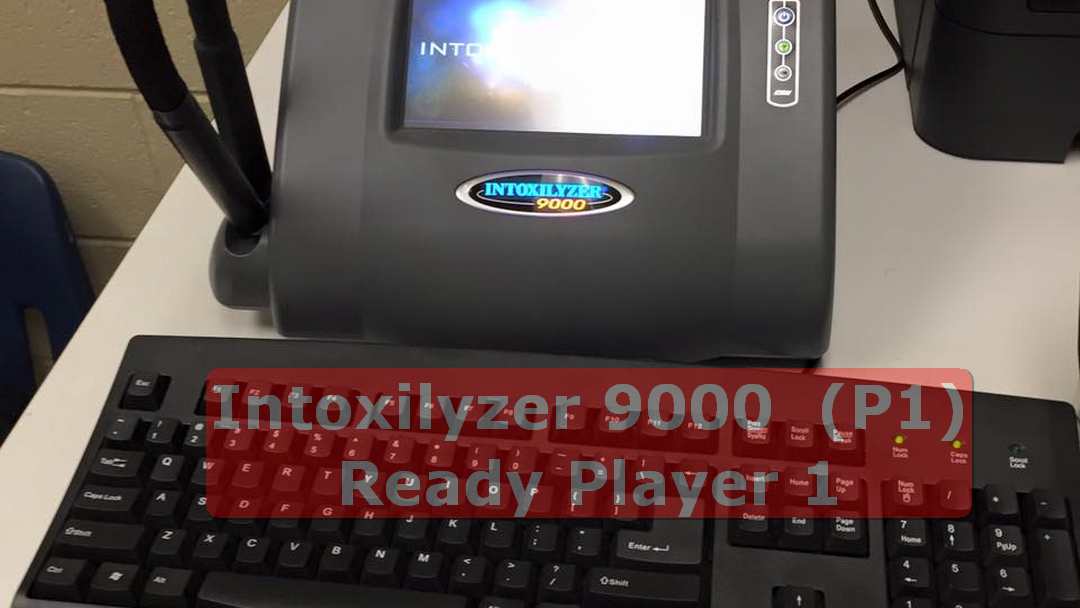

The Intoxilyzer 9000 (part 1)

The Intoxilyzer 9000 (part 1 of 2)Roll-Out The Michigan State Police (MSP) initiated Intoxilyzer 9000 (Intoxilyzer) training for police officers statewide, commencing in 2023. In order to participate, officers were required to complete both preliminary breath test...

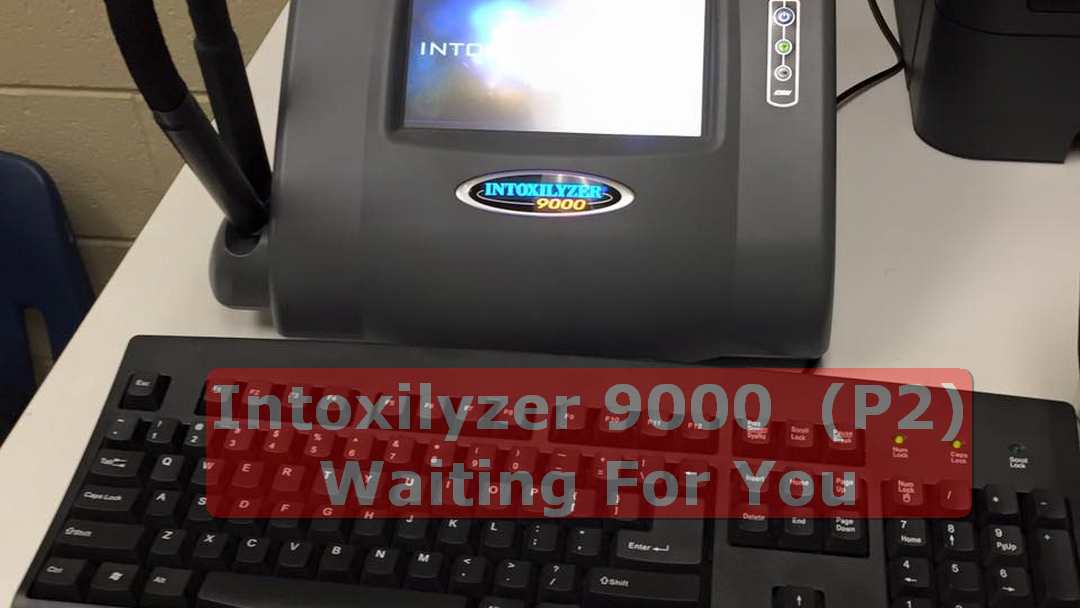

The Intoxilyzer 9000 (part 2)

The Intoxilyzer 9000 (part 2 of 2)Using it The Intoxilyzer is user-friendly and equipped with a built-in feature to alert officers of any potential issues. As a precautionary measure, officers are specifically advised to switch off their portable radios prior to...

Our Kids are Dying of Drug Overdoses

THE KIDS AREN’T ALRIGHT, THEY’RE DYING OF DRUG OVERDOSESFrom May 2022 to May 2023, the Centers for Disease Control and Prevention reported an alarming 37 percent increase in American lives lost due to overdoses, totaling over 112,000 fatalities. This staggering surge...

How DUI Charges Impact Your Child’s Future

In Michigan driving is considered a privilege. with this privilege comes immense responsibility, especially when it comes to driving under the influence (DUI) as well as other responsibilities. The consequences of youth DUI extend far beyond the immediate legal...

Rescheduling Marijuana Would Be a Threat to Public Health

Kevin Sabet of Smart Approaches to Marijuana says policy makers need to learn from their mistakes with hemp when considering marijuana rescheduling. It’s rare for policymakers to get a preview of the consequences of pending policies, but the descheduling of...

Meet MiChap

Climate and Health Adaptation ProgramYou must save yourself from yourself.Meet MICHAPOur Vision: Michigan's public health system fosters equitable health and wellbeing as it adapts to the current and future impacts of climate change. Our Mission: The Michigan Climate...

Feds discover new methods to distinguish hemp and marijuana to assist crime labs

Federally funded researchers have uncovered two methods to divide and diversify the difference between hemp and cannabis to assist to crime labs. Because Cannabis is still a crime and Hemp is not...The Controlled Substance Act of 1970 classified the plant cannabis,...

Laws passed by Michigan lawmakers in 2023 will take effect

Several new laws passed by Michigan lawmakers in 2023 will take effect on Tuesday, Feb 13, 2023Making use of the first combined Democratic majority in the state House, Senate, and governor's seat in decades, legislators have the numbers and have successfully approved...