Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

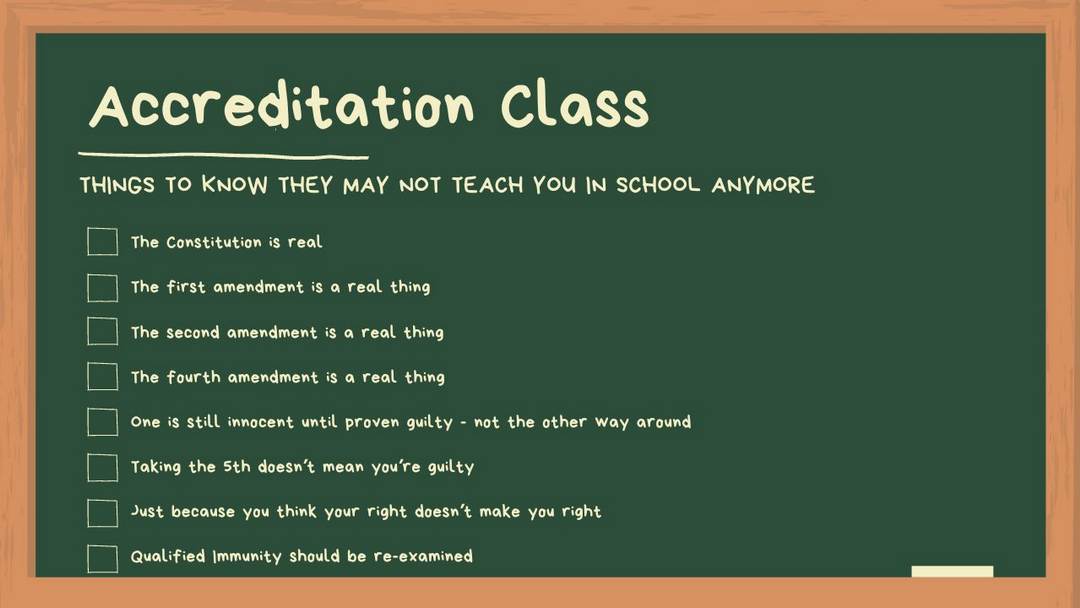

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

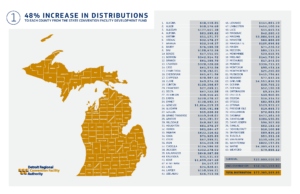

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

CRA Executive Director Hanna Applauds Whitmer’s FY25 Budget

No Evidence of Widespread Discriminatory Policing PracticesNever Ending Quest February 15, 2024 LANSING, MI – Today, Cannabis Regulatory Agency (CRA) Executive Director Brian Hanna applauded Governor Gretchen Whitmer’s Fiscal Year (FY) 2025 Executive Budget...

Judge tosses lawsuits stemming from Michigan’s marijuana recall

Judge tosses lawsuits stemming from Michigan’s marijuana recall LANSING, MI -- A Michigan Court of Claims judge on Jan. 2 dismissed two lawsuits linked to Michigan’s enormous 64,000-pound, $229 million 2021 marijuana recall that impacted an estimated 60% of all...

Decision holding mandatory life without parole unconstitutional

COA 352569 PEOPLE OF MI V JOHN ANTONIO POOLE Opinion People v Poole (Docket No. 352569) decided January 18, 2024 The State Appellate Defender Office celebrates today’s outcome for our client John Antonio Poole. As an 18-year-old child, Mr. Poole was sentenced to life...

Michigan Marijuana Sales Surpassed $3 Billion In 2023

In 2023 according to sources on the internet the Michigan lottery made 46 million , liquor taxes made $31.5 billion this year, a slight increase from previous projections but close to $400 million less than the previous year. Marijuana about 3 billion. Michigan's...

More Posts

Legal Consequences of Rescheduling Marijuana – 2024

Legal Consequences of Rescheduling Marijuana Jan 2024 a report from the Congressional Research Service.

Scientists Discover The Reason Cannabis Causes The Munchies

For the first time, scientists have uncovered the precise neurological impacts of cannabis use that give rise to the phenomenon famously referred to as the "munchies," as revealed by an innovative study backed by federal funds. Researchers at Washington State...

Maker of CBD products asks court to decide

The Petitions of the Week column highlights a selection of cert petitions recently filed in the Supreme Court. A list of all petitions we’re watching is available here. Organized crime, from the mafia to small-time money laundering schemes, often evades criminal...

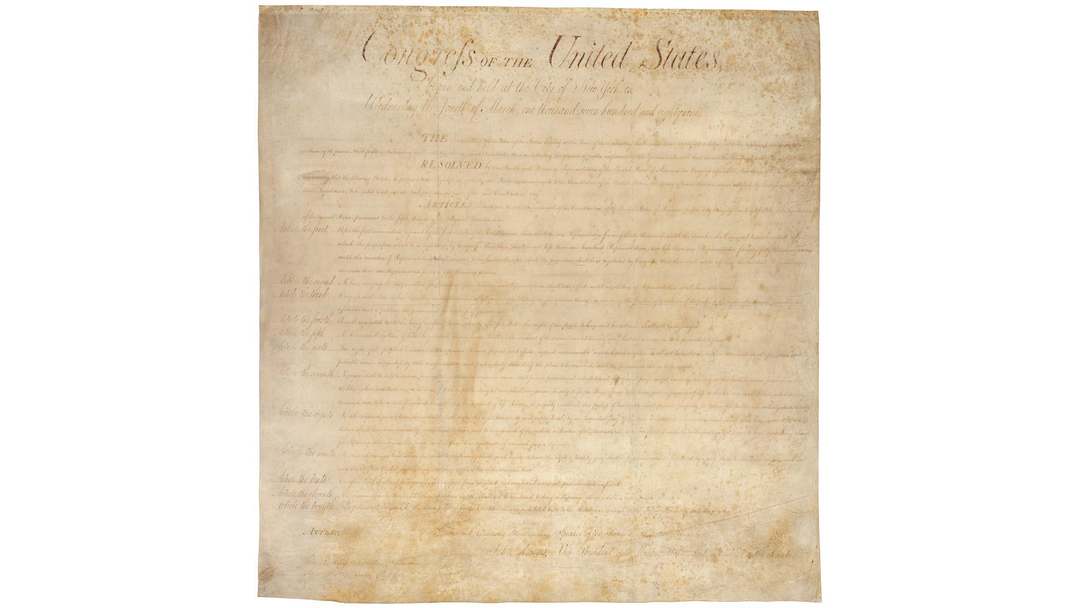

Transcription of the 1789 Joint Resolution of Congress Proposing 12 Amendments to the U.S. Constitution

This information was taken from archives.gov. One should assume it is factual... but assuming information is a fact is a perilous assumption. Here is what you paid for... Transcription of the 1789 Joint Resolution of Congress Proposing 12 Amendments to the U.S....

New laws for 2024 – Buckle Up

States nationwide will welcome the upcoming year with the implementation of laws tackling crucial matters such as gun violence, book bans, and the introduction of gender-neutral toy sections. These legislative advancements are set to take effect throughout 2024,...

Biden Issues More Cannabis Pardons but…

Joe Biden has extended pardons for individuals charged with simple cannabis possession and use, yet disappointingly, he has refrained from granting clemency to those currently incarcerated for cannabis-related offenses.In an extension of the previous year's extensive...

Working With and Not Against, IRS Revenue Code 280E

Cannabis operators face IRS Revenue Code 280E restrictions, but smart tax planning and strategies allow entrepreneurs to mitigate its impact on their business.Komorn Law is Michigan's top cannabis law firms when it comes to licensing, consulting and legal defense....

Department of Attorney General Prepares for MLEAC Accreditation

LANSING – The Michigan Department of Attorney General (DAG) recently welcomed a team of assessors from the Michigan Law Enforcement Accreditation Commission (MLEAC). The assessors came to examine all aspects of the Department’s compliance with the MLEAC standards in...

Oklahoma’s wild marijuana market is about to shrivel

The world's weed market, once booming with nearly 14,000 licensed medical marijuana businesses at its peak, has experienced a steady decline since Oklahoma voters overwhelmingly rejected a recreational legalization referendum in March. Heightened enforcement by state...

400K settlement after being arrested for a DUI, even though he passed breath and blood tests

A Colorado man is poised to receive a $400,000 settlement from city authorities after being wrongfully arrested for a DUI, even though he had passed both a breath and blood test.According to the complaint, Elias was driving southbound on College Avenue in Fort Collins...