Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

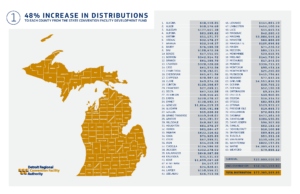

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

Whitmer signs bill stripping gun rights for non-violent offenders

Gov. Gretchen Whitmer proudly showcases a crucial bipartisan gun violence bill package that she recently signed into law, underscoring her unwavering dedication to safeguarding the lives of those vulnerable to domestic violence. This essential measure reflects the...

Judge blocks media access to Michigan marijuana hearings

Michigan’s largest-ever marijuana recall is at the center of a court matter that the public is forbidden from attending. The case focuses on Cannabis Regulatory Agency accusations that Viridis Laboratories, one of the largest marijuana safety testing labs in the...

Michigan marijuana testing lab says potency results are legit

Controversial Michigan marijuana testing lab says potency results are legit. IT HAS PROOF! Michigan regulators and the state’s largest marijuana safety testing lab are at odds. When customers purchase marijuana off shelves, the Cannabis Regulatory Agency (CRA) has...

Super potent weed spurs distrust in Michigan marijuana industry

In case you missed it... The validity of results issued by marijuana safety labs in Michigan and across the nation have been called into question. There are allegations of labs intentionally issuing higher THC potency test results -- which makes the marijuana more...

More Posts

When Being Questioned by the Police: Can They Lie to You?

When Being Questioned by the Police: Can They Lie to You? Introduction In the United States, police officers are generally allowed to lie to suspects during interrogations. This is a controversial practice, but it has been upheld by the Supreme Court. There are some...

Ohio Bill Introduced to Allow Each City to Ban Marijuana

With just over a week until Ohio’s voter-approved marijuana legalization law takes effect, a lawmaker has introduced a bill that would allow individual municipalities to locally ban the use and home cultivation of cannabis in their jurisdictions. The legislation aims...

Appeals Court – Detroit’s Asset Forfeiture Violates Due Process

A federal circuit judge writes that Detroit's vehicle seizure scheme "is simply a money-making venture—one most often used to extort money from those who can least afford it." A panel of federal appellate judges ruled that Detroit's practice of seizing people's cars...

NEWS RELEASE: USSC Adopts 2023 Amendments

WASHINGTON, D.C. ― Equipped with a quorum of Commissioners for the first time since 2018, the bipartisan United States Sentencing Commission voted today to promulgate amendments to the federal sentencing guidelines. “The Sentencing Commission is back in business,”...

Bad Ranking For Transparency in the Michigan Justice System

by Wes Smith, president, MPA Board of DirectorsPublisher View Newspaper Group When there was a change in leadership in Michigan’s legislature earlier this year, hope rose again in the hearts of citizens who want a more transparent state government. Maybe, it was...

Ohio voters say yes to legal recreational cannabis

Recreational marijuana has been legalized in Ohio as voters overwhelmingly approved State Issue 2 on Tuesday. This groundbreaking decision now enables adults in Ohio to legally experience the advantages of marijuana for recreational purposes. “Marijuana is no longer a...

Smell of Marijuana is Not Enough to Search Your Vehicle or is it?

The Smell of Marijuana and the Court of Appeals Body camera footage is an invaluable resource for courts facing suppression motions, but it rarely serves as a stand-alone source of information about a warrantless search or seizure. Here, the trial court was hamstrung...

Commission Votes For Retroactive Sentencing

U.S. SENTENCING COMMISSION VOTES TO ALLOW RETROACTIVE SENTENCE REDUCTIONS AND ANNOUNCES ITS NEXT SET OF POLICY PRIORITIESVote Authorizes Judges to Reduce Sentences for Eligible Incarcerated Persons Beginning February 1, 2024 Should Guidelines Become...

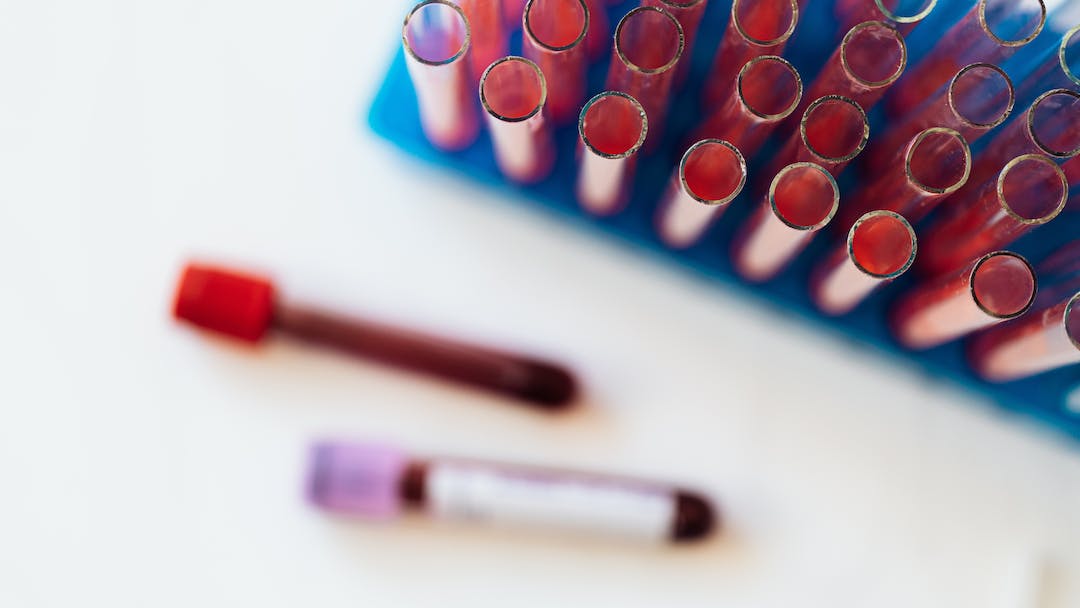

THC Detection in Blood: Challenges and Implications

THC Detection in Blood: Challenges and Implications When it comes to enforcing drugged driving laws, police and employers face a unique challenge with marijuana. Unlike alcohol, which is metabolized and eliminated relatively quickly, THC, the psychoactive compound in...

Feds New Sentencing Guidelines for Past Cannabis Convictions

The federal U.S. Sentencing Commission (USSC) has approved a revised amendment to sentencing guidelines, advising judges to adopt a more lenient approach towards prior marijuana possession offenses. Members of the commission voted to approve a range of amendments to...