Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

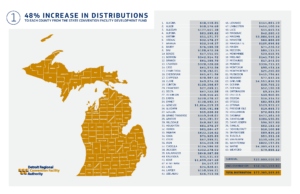

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

Judge limits Michigan marijuana recall to half the product initially covered

A marijuana recall will proceed in part after a judge denied a testing company's request for a preliminary injunction for a recall of products tested by one of its labs, but allowed it for the other. The split decision from Michigan Court of Claims Judge Christopher...

Michigan lab fights back in court after marijuana recall

A marijuana lab licensed in Michigan is suing the Marijuana Regulatory Agency (MRA) over a recall that impacted nearly $230 million worth and 64,000 pounds of marijuana products in the state. Michigan Court of Claims Judge Christopher M. Murray on Monday appeared to...

Official Notification of Marijuana Product Recall

The Marijuana Regulatory Agency (MRA) has identified inaccurate and/or unreliable results of products tested by laboratories Viridis North, LLC and Viridis Laboratories, LLC. A link to the locations affected by the recall is at the end of this information In the...

More Posts

THC Detection in Blood: A Comprehensive Review

THC Detection in Blood: A Comprehensive Review Tetrahydrocannabinol (THC), the main psychoactive compound in marijuana, can remain detectable in the blood for several days or even weeks after use. This is due to the fact that THC is highly fat-soluble, meaning that it...

It’s not hard to be accused of being a Menace in Michigan

“You are a menace, you’re talking louder than me, you don’t agree with me and now you're pointing at me with gun fingers. I feel threatened! I’m calling the police”. All over a minor disagreement - probably about paper or plastic. Police arrive and can only do what...

Skymint acquired out of receivership

Tropics LP, under a new entity called Skymint Acquisition Co., acquired the assets of Green Peak Industries, doing business as Skymint, for $109.4 million. Nuff saidPlease note that cannabis at the time of this post being published is still a controlled substance...

Trulieve seeks $143M federal refund for 280E taxes

Would enforcing payment and accepting money from a federally illegal business cause you to be caught up in RICO, CCE and conspiracy charges that would put you away for decades? For you yes - For the government a big NO.Multistate marijuana company Trulieve Cannabis...

Feds Clarify Doctor Prescribed Medical Cannabis Is No Excuse

The revised federal workplace drug testing guidelines, issued by the Substance Abuse and Mental Health Services Administration (SAMHSA), Department of Health and Human Services (HHS), are intended to provide clarity. These guidelines emphasize that individuals who use...

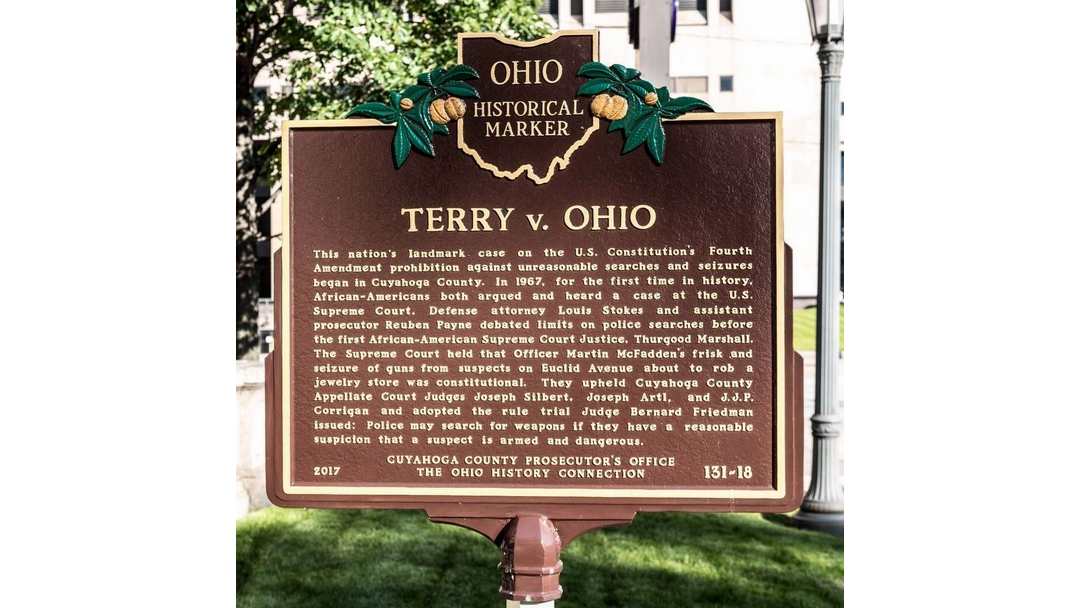

Stop and Frisk – Terry v. Ohio

Terry v. Ohio (1968)Background On October 31, 1963 while conducting his regular patrol in downtown Cleveland, seasoned Cleveland Police detective Martin McFadden, who brought 39 years of law enforcement experience to the job, observed three men behaving suspiciously...

Can I have open alcohol in a trailer that is being pulled on the road?

Question: Can I have open alcohol in a trailer or camper that is being pulled on the road? Answer: In most instances transporting or possession of open intoxicants in a vehicle is not permitted. MCL 257.624a states in part, "a person who is an operator or occupant...

How Much Does it Cost for an Expungement in Michigan?

Ask yourself - How much is your record costing you not to have it expunged.When you have been convicted of a crime in Michigan, you are likely aware of the negative impact it can have on your life, even after you have knelt in submission, paid the fines, served your...

Pending Charges?

Pending Charges. Don't wait. Get ahead of their game. If you have been arrested but not charged yet. Don't wait while they build evidence and take your statements to use against you! They may just be building a case against you and letting you get more comfortable...

Conspiracy is a Crime

In Michigan, conspiracy is a crime that is defined as "the agreement between two or more persons to commit any crime." The crime of conspiracy could be considered complete even if the actual crime is never committed. Conspiracy is a felony in Michigan, and the...