Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

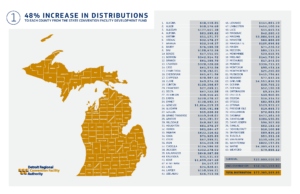

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

Whitmer’s $3B plan to fix Michigan’s roads calls for more taxes

Same Thing - Different DayWhitmer's $3B plan to fix Michigan roads calls for more corporate, marijuana taxes, taxes at the pump and you can just imagine the ones you don't know about.Michigan Governor Gretchen Whitmer has introduced a comprehensive three billion...

Making terrorist threat or false report of terrorism is free speech?

Making terrorist threat or false report of terrorism is free speech?The US Constitution and Michigan Constitution prohibit the government from making laws that abridge the freedom of speech Summary In the case of People of the State of Michigan v. Michael Joseph...

Qualifying for a Public Defender in Michigan

In Michigan, individuals charged with a crime have the constitutional right to legal representation.In Michigan, individuals charged with a crime have the constitutional right to legal representation. For those unable to afford a private attorney, the state provides...

Earned Sick Time Act – 2025 New Laws in Effect for Michigan

Some laws in effect in 2025 "Enacted by the People of Michigan" Here we go...remember these laws can change at any moment because that's what the politicians do that you don't.Earned Sick Time Act Because everyone is sick...sometimes Read more on your own time.AN ACT...

More Posts

If I renounce my US citizenship can I get it back?

Venezuela or Bust If I renounce my U.S. citizenship can I get it back?Renouncing U.S. citizenship is a serious legal action. It involves voluntarily giving up your status as a U.S. citizen, usually by signing an oath of renunciation at a U.S. embassy or consulate...

New Laws in Effect for Michigan in 2025

Some laws in effect in 2025 "Enacted by the People of Michigan" Here we go...Minimum wage Improved Workforce Opportunity Wage Act - Michigan's minimum wage will increase twice during 2025, per a 2018 Supreme Court ruling. Starting Jan. 1, 2025, the standard minimum...

The Police Took Your Cellphone – Now What?

Everything you have and say will be evidence used against you. The Police took your cellphone - Now what?After your arrest, you arrive at the police station where you go through the booking process, and your cellphone is taken from you. Once you are released, your...

Feeling Bullied? Here’s Michigan’s Anti Bullying Laws.

Michigan Anti-Bullying Laws & Policies Components of State Anti-Bullying Laws and Regulations How are bullying and cyberbullying defined in Michigan anti-bullying laws and regulations? Michigan anti-bullying laws and regulations include the following...

Former 3M scientist who made unsettling PFAS discovery says bosses deceived her

Gee - What a surprise... When a former 3M scientist discovered the company’s chemicals were in human blood in the general population, she says her bosses misled her to believe it was harmless.3M accused of deceiving its own scientist about PFAS in human blood Hansen...

Drones – What Drones?

Jersey cops launched into the night sky with catapults to throw dreamcatchers at the unknown drones to entangle their props and bring em down! Just kidding - I think.Darrr.. What drones? Those drones pose no threat there are no drones. That's just a balloon,...

Cash For Kids Judge Pardoned (The Kickback Club)

Biden’s commutation for Judge in ‘kids for cash’ scandal should anger the entire universe.Biden’s commutation in ‘kids for cash’ scandal. BY MICHAEL RUBINKAMUpdated 5:32 PM EST, December 13, 2024A judge implicated in one of the most notorious judicial scandals in U.S....

How Much Does It Cost To Hire a Criminal Defense Attorney?

Don't do the crime - if you can't pay the price.Average Flat Fees. Some criminal defense attorneys charge a flat fee for certain types of cases, instead of billing by the hour. This may or may not include filing fees, motions, fees, etc. Flat fees include: DUI/DWI –...

What do you do when you are pulled over for suspected DUI?

If you are pulled over for suspected drunk driving you are probably going to be arrested. The less you say - the better off you are in the long run. If you find yourself being pulled over for suspected DUI, ensure you pull over safely to the roadside, maintain a...

Trump plans – How does Cannabis Business fit in?

You work hard. Now get ready to work harder to prepare to give more.President Biden's administration has proposed the reclassification of marijuana from a Schedule I controlled substance to a Schedule III drug, which recognizes its medical benefits. This significant...