Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

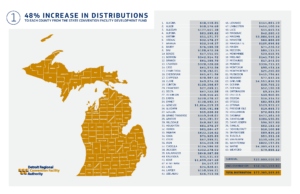

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

Michigan Problem-Solving Courts Granted Nearly $19 Million

"Data show these programs strengthen communities by reducing crime, boosting employment"LANSING, MI, October 24, 2024 (Substance Abuse Prevention Month) – The Michigan Supreme Court announces that the State Court Administrative Office (SCAO) has awarded $18,823,910...

Michigan House Bill 5451 of 2024

Michigan House Bill 5451 of 2024: A Step Toward "Safer Communities"Michigan House Bill 5451, introduced by Representative Sharon MacDonell in February 2024, aims to enhance firearm safety in homes with children. The bill mandates that the Department of Health and...

Michigan House Bill 5450 of 2024

Step by StepMichigan House Bill 5450 of 2024 is a bill that was introduced by Representative Sharon MacDonell on February 14, 2024. The bill was referred to the House Committee on Education and was reported with a recommendation with a substitute on May 14, 2024. The...

Search and Seizure – Consent or Plain view

The Fourth Amendment was established to protect individuals from unreasonable searches and seizures, yet there are exceptions.In Michigan, understanding the concepts of search and seizure, particularly regarding consent and plain view, is crucial for both law...

More Posts

When Can Police Take Your Dash Cam?

You work hard. Now get ready to work harder to prepare to give more.In Michigan, police can take your dashcam footage in specific situations, primarily when they believe it could serve as evidence in a criminal investigation. Michigan law permits officers to seize...

People who are going to need a Lawyer – November 12, 2024

People who are going to need a LawyerMan so drunk field sobriety tests were ‘too dangerous’ sentenced to life in prison for repeated DWI convictions‘Several terabytes’: Diddy prosecutors shed light on ‘voluminous’ discovery, including iCloud accounts and dozens of...

Cambridge Analytica data breach comes before court

Oral arguments in Facebook v. Amalgamated Bank will beginThe justices are set to review securities law as they hear arguments in a significant case linked to the 2015 data breach involving Cambridge Analytica and Facebook. The tech giant’s effort to fend off federal...

Search and Seizure – Consent or Plain view

The Fourth Amendment was established to protect individuals from unreasonable searches and seizures, yet there are exceptions.In Michigan, understanding the concepts of search and seizure, particularly regarding consent and plain view, is crucial for both law...

A drunk driving investigation, a car wreck and a blood draw

A Case Summary: People v. Blake Anthony-William BartonOn October 11, 2024, the Michigan Court of Appeals issued a decision in the case People of the State of Michigan v. Blake Anthony-William Barton. The case involved a drunk driving investigation following a car...

Police say they can tell if you are too high to drive

Police say they can tell if you are too high to drive. Critics call it ‘utter nonsense’Haley Butler-Moore sped up to pass a semi on the highway when she suddenly saw the police lights. She’d left Albuquerque hours earlier, heading to a Halloween party in Denver. Tired...

Cannabis – The Rise and Fall and Trail of Survivors Pile Up

Thieves make off with 1,000 pounds of premium flower in cannabis from a corporate grower in Michigan. Then, the GM sells off 650+ pounds to pay employees.The recent theft of over 1,000 pounds of marijuana from 305 Farms, a corporate cannabis grower in West Michigan,...

If you have an LLC you must comply or face fines and possible prison

You work hard. Now get ready to work harder to prepare to give more.If you own or are a member of an LLC.You have a deadline of January 1, 2025Call us we can take care of it for you. 248-357-2550The new Beneficial Ownership Reporting requirements for LLCs and other...

Compounding Charges Laws in Michigan

Understanding Compounding Charges Laws in Michigan Compounding charges refer to the illegal act of accepting or agreeing to accept a benefit in exchange for not prosecuting a crime. In Michigan, this is considered a serious offense, and the law specifically prohibits...

Harris unveils new proposals targeting black men with cannabis legalization

"Harris unveils new proposals targeting Black men as she looks to shore up Democratic coalition" CNNAmid the ongoing national issues, Vice President Kamala Harris introduced new initiatives on Monday aimed at addressing the needs of Black men as she works to bolster...