Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

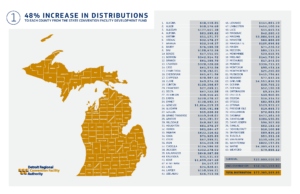

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

Government Drones in Your Life – Yes, They Made up a Reason

Long Lake Township v. Maxon The Costs Outweigh Benefits in Exclusionary Rule Application and the Slippery Slope of Fourth Amendment ProtectionsThe recent decision by the Michigan Supreme Court in Long Lake Township v. Maxon represents a significant shift in the...

Oakland County Sheriff’s deputy fatally shot in ‘ambush’ while following stolen car

Oakland County Sheriff's deputy fatally shot in 'ambush' while following stolen carA deputy investigating a stolen car was shot to death Saturday night in Detroit in what Oakland County Sheriff Michael Bouchard called an ambush. Oakland County Sheriff's Deputy Bradley...

This drug will eat your flesh turn your skin green and it’s in Michigan

This illicit drug will eat your flesh, turn your skin green, scaly and it's in MichiganWe did not post any pictures depicting the results of abuse because it is horrifying. If you must see - Google for images of Krokodil.Authorities are warning to be cautious of...

$700 Million Settlement Against Johnson and Johnson – What’s Your Cut?

Attorney General Nessel Reaches $700 Million Settlement Against Johnson and JohnsonYour mom and your dad have been covering you with Johnson and Johnson powder since you were a baby. There was always a cloud of powder in the air as they slapped it on you. It got all...

More Posts

The MSP and Your Privacy (Criminal History)

Is the Michigan State Police really concerned about your criminal history privacy?Here's what they say on their websiteThe Michigan State Police (MSP) is committed to protecting the privacy of your potentially personally identifiable data (PPID) in a strong and...

The 6th Amendment – Do You Know What It Is?

The 6th Amendment: is it still a thing?The 6th Amendment to the United States Constitution is a crucial pillar of the Bill of Rights, designed to ensure fair and just legal proceedings for individuals accused of crimes. Ratified on December 15, 1791, this amendment...

The US Supreme Court and Federal Gun Law Cases

The US Supreme Court and Federal Gun Law CasesChallenges to Federal Gun Laws the right of the people to keep and bear Arms, shall not be infringed Updated July 8, 2024 Ratified in 1791, the Second Amendment provides, “A well regulated Militia, being necessary to the...

Do Passengers in a Vehicle have 4th Amendment Rights?

Do Passengers have 4th Amendment Rights?Michigan Supreme Court Limits Police Ability to Search Passenger Property in CarsBackground Mead was a passenger in a car and had just met the driver, who offered him a ride. When the police stopped the vehicle and ordered both...

Do Students Have 4th Amendment Rights in Schools

Students and 4th Amendment RightsStudents are entitled to a right to be safe from unreasonable searches and seizures even within school premises, as ruled by the Supreme Court of the United States. However, these rights are somewhat limited for students, allowing...

Forfeiture Law: SCOTUS and Sixth Circuit Issue Landmark Rulings

Forfeiture Law in Focus: SCOTUS and Sixth Circuit Issue Landmark RulingsThe landscape of forfeiture law has been significantly shaped by recent decisions from the U.S. Supreme Court and the Sixth Circuit Court of Appeals. These rulings, in the cases of United States v...

Facial Recognition and Wrongful Arrests

Facial RecognitionHow Technology Can Lead to Mistaken-Identity Arrests Facial recognition technology has become increasingly prevalent in law enforcement, but its use raises critical questions about civil liberties and accuracy. One landmark case sheds light on the...

People v. Chandler Case: Protecting Fourth Amendment Rights

Court of Appeals of Michigan PEOPLE of the State of Michigan, Plaintiff-Appellee, v. Javarian CHANDLER, Defendant-Appellant. No. 368736 Decided: June 27, 2024Before: Borrello, P.J., and Swartzle and Young, JJ. Introduction In the People v. Chandler case, the Michigan...

MI Lawyer Weekly – Michigan’s Go To Lawyers for Cannabis Law

Please join us in congratulating our inaugural Michigan’s Go To Lawyer for cannabis law. Michael Komorn, Komorn Law, Farmington HillsMichigan Lawyers Weekly is pleased to announce the inaugural “Go To Lawyers” for cannabis law. Now in its fifth year, the “Go To...

Chinese-funded marijuana farms springing up across the U.S.

Inside the Chinese-funded and staffed marijuana farms springing up across the U.S.During a farm inspection, New Mexico state special agents discovered an excessive number of cannabis plants in violation of state laws. Subsequent visits revealed dozens of underfed and...