Adult-Use Marijuana Tax Payments Being Distributed In Michigan

Here’s what they say…

Treasury: Adult-Use Marijuana Payments Being Distributed to Michigan Municipalities and Counties; More Than $59.5 Million Going to 224 Municipalities and Counties.

Sales of “legal” marijuana in Michigan contributed $266.2 million in tax revenue to the government during the most recent fiscal year, according to a new report from the legislature’s nonpartisan House Fiscal Agency.

That’s more than the state made from the sale of beer, wine and liquor combined.

February 28, 2023

The Michigan Department of Treasury today announced that more than $59.5 million is being distributed among 224 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act.

Over the next few days, 81 cities, 26 villages, 53 townships and 64 counties will receive payments from the Marihuana Regulation Fund. For the state of Michigan’s 2022 fiscal year, this means each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction.

“Municipalities and counties will begin seeing these payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities.”

Revenue was collected from 574 licensees among the state’s cities, villages and townships during the 2022 fiscal year. Some of these municipalities host more than one licensed retail store and microbusiness.

For the 2022 state fiscal year, there was $198.4 million available for distribution from the Marihuana Regulation Fund.

State law outlines how much is distributed from the Marihuana Regulation Fund.

Aside from the more than $59.5 million in disbursements to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education and another $69.4 million to the Michigan Transportation Fund.

In total, more than $1.8 billion in adult-use marijuana sales was reported for Fiscal Year 2022.

“The team at the CRA does an amazing job and our effective regulatory approach allows our licensees to provide Michigan’s cannabis consumers the safest possible product,” said CRA Executive Director Brian Hanna. “The funding that makes its way to local governments through the excise tax collected by licensed retailers is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

Where they say the money goes…

Adult-Use (Recreational) Marijuana

Adult Use Break Downs

$226m – $59m = $167m (left over after distribution…nice haul)

Marijuana funds collected under the Michigan Regulation and Taxation of Marihuana Act (Initiated Law 1 of 2018) are distributed, upon appropriation, as follows:

- 15% to municipalities in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the municipality.

- 15% to counties in which a marijuana retail store or a marijuana microbusiness is located, allocated in proportion to the number of marijuana retail stores and marijuana microbusinesses within the county.

- 35% to the School Aid Fund to be used for K-12 education.

- 35% to the Michigan Transportation Fund to be used for the repair and maintenance of roads and bridges.

Links

MEDICAL Marijuana Break Downs

For more information about adult-use marijuana tax distributions – including a breakdown of how much municipalities and counties received – go to Michigan.gov/RevenueSharing. To learn more about Michigan’s adult-use marijuana industry, go to Michigan.gov/cra.

Source: https://www.michigan.gov/treasury/news/2023/02/28/adult-use-marijuana-payments-being–distributed-to-michigan-municipalities-and-counties

Have your rights been violated?

Have your driving priviledges been revoked?

Has your professional license been suspended?

Second Amendment rights taken away?

Have you been charged with a crime?

Call our office to see if we can help

Komorn Law 248-357-2550

More is always better for the Government

Legislative Update 12-9-22

Liquor tax funding change means $25 million boost to counties

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

A two-bill package designed to extend the capture of liquor tax revenue that counties use for substance abuse programs passed during the last days of the legislative session this week and will soon mean a $25 million boost to counties.

Senate Bills 1222-23, by Sen Wayne Schmidt (R-Grand Traverse), amend the State Convention Facilities Authority Act to extend the sunset on the capture of liquor tax revenue for improvements to the convention facility in Detroit and therefore extend the sunset on the collection of liquor tax revenue for counties.

The issues were tied together when the act was created. Under current law, the collection and allocation of the liquor tax revenue expires once the bonds for the convention facility are paid off. Due to recent increases in liquor tax revenue, those bonds are scheduled to be paid off 13 years early, which would eliminate the future collection of revenue and deplete the allocation to counties. This two-bill package does not extend the 2039 deadline for the bonds to be paid off, but it does allow the facility authority to issue additional bonds for improvements.

MAC has been working with representatives from the authority to address our need to have counties’ annual allocation reflective of the collection of the liquor tax revenue. Current law states counties receive an increase in their allocation based on a percentage above the previous year’s allocation, not on a percentage of the total tax collected. The excess tax collected is instead allocated to the reduction of the bond debt of the authority. (Again, due to the increase in liquor tax revenue, those bonds are scheduled to be paid off early.)

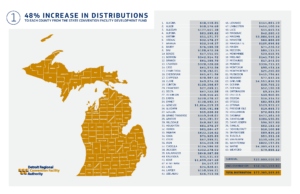

By allowing the authority to issue additional debt for improvements, the bills do something significant for counties. Beginning in 2023, the baseline allocation in liquor tax dollars for counties will increase by approximately 48 percent — or $25 million. (See county-by-county estimates.) The annual increase will remain the same as current law of 1 percent additional each year, but the baseline will be reset every three years to reflect the increase in revenue from the liquor tax.

Also, current law states 50 percent of the liquor tax revenue received by counties must be allocated to substance abuse programs. SBs 1222-23 will change that requirement to 40 percent (though no less than the amount allocated in FY22). In short, this will be a significant increase in funds toward substance abuse programs and an increase in the amount counties can allocate to their general funds.

The bills are now headed to the governor for her expected signature.

For more information on this issue, contact Deena Bosworth at bosworth@micounties.org.

Related Articles

Woman high on cannabis panics and jumps from rideshare on I-96

Not a good ideaA woman, who was allegedly under the influence of cannabis, experienced a moment of panic while riding in a rideshare vehicle. In a concerning turn of events, she chose to abruptly exit the moving vehicle on I-96 near I-94, according to reports from...

Senate considers bill making governor, lawmakers eligible for FOIA

Why this was not a thing and passed decades ago would be a good question.The Senate oversight committee will review a bill that aims to extend Michigan's Freedom of Information Act to cover lawmakers and the governor's office. Senate Bills 669 and 670 aim to expand...

Whitmer supports opt-out system for state park passes

Whitmer expressed her support in her 2025 budget recommendations for legislation that would automatically charge vehicle owners a fee for entry to state parks. Another fine piece of legislation introduced House Bill 5428, which would automatically take from vehicle...

Michigan wants to study marijuana’s health benefits

MICHIGAN WANTS TO STUDY MARIJUANA’S HEALTH BENEFITSWhen Michigan voters approved recreational marijuana six years ago, they also allocated cannabis tax revenue for research into the health benefits of the drug specifically for military veterans. In a remarkable...

More Posts

A visit with a kick

POW - Right in the Kisser. Businesses watch out for the lawA Pennsylvania-based convenience store chain was hit with a lawsuit by the Biden administration at the same time the president stopped by one of their locations on the campaign trail. Sheetz is being accused...

Woman tried to board flight with 56 pounds of marijuana

Woman allowed airport police to check her luggage, had name tag on bags, according to reportsBefore a 21-year-old Memphis woman could board an United Airlines flight, Memphis International Airport Police found 56 pounds of marijuana in her luggage, according to...

You’re too stupid to store a gun properly

The Biden administration once again defends a ban in federal court, arguing that people who use marijuana should be prohibited from purchasing or possessing firearms. They claim that this restriction is supported by historical precedent and that individuals who...

Illegal Firearms in Michigan

Illegal Gun Ownership in Michigan: Insights and StatisticsThe issue of illegal gun ownership in Michigan is a complex one, influenced by various factors ranging from criminal activity to loopholes in regulatory measures. Understanding who owns illegal guns is crucial...

Restoring Second Amendment Rights in Michigan

Restoring Your Gun RightsAs of 4/17/24...There is still a second amendment The Second Amendment of the United States Constitution grants citizens the right to bear arms, a fundamental aspect of American freedoms. However, in some cases, just like every other right...

Oregon governor signs a bill recriminalizing drug possession

Oregon governor signs a bill recriminalizing drug possession into lawOn April 1, 2024, Oregon Governor Tina Kotek signed House Bill 4002 into law, effectively recriminalizing the possession of small amounts of certain controlled substances. This legislation marks a...

John Sinclair, the inspiration for Ann Arbor’s Hash Bash, dead at 82

John Sinclair, the poet whose imprisonment for marijuana inspired the start of Ann Arbor’s long-running annual Hash Bash in the 1970s, has died. He was 82.Sinclair's passing occurred on Tuesday, April 2, 2024, at a Detroit hospital, merely four days prior to his...

Disciplining Student’s Speech Violates First Amendment

You go girl!!!A public high school was found to have violated the First Amendment when it suspended a student from her cheerleading team for using profane speech off campus. Mahanoy Area Sch Dist v BL, No 20-255, ___ US ___ (June 23, 2021). The U.S. Supreme Court has...

Marijuana reform advocates demand apology from Kamala Harris

So SorryMarijuana reform advocates demand an apology from Kamala Harris for locking up pot smokers and slam her 'political hypocrisy' for now saying no one should 'go to jail for smoking weed!'Marijuana reform advocates are urging Vice President Kamala Harris to issue...

Federal Agency Smack Down on a Michigan Credit Union’s Cannabis Banking

Apple to ApplesAn independent federal agency has recently cited a Michigan credit union for non-compliance with regulations regarding banking services for the marijuana industry. Consequently, the financial institution has been directed to halt the opening of new...