October 2, 2023 – The Senate Banking Committee’s historic vote propels the SAFER Banking Act to the Senate floor, marking a significant milestone. The bill must now navigate the Senate and the House of Representatives before reaching President Biden’s desk. Cannabis dispensaries have embraced this legislation, expressing their admiration of course.

Earl Blumenauer (D-OR) and Dave Joyce (R-OH) who introduced SAFE Banking the House, released the following statement on the passage of the SAFER Banking Act in the Senate Committee on Banking, Housing, and Urban Affairs:

“This legislation will save lives and livelihoods. The overwhelming majority of Americans live in a state where cannabis is legal in some form. It is common sense and an urgent matter of public safety that these legitimate cannabis businesses have access to standard banking services.”

Former Colorado Democratic Congressman Ed Perlmutter has been pushing for the Secure and Fair Enforcement Regulation Banking Act, or SAFER Banking Act, for a decade now.

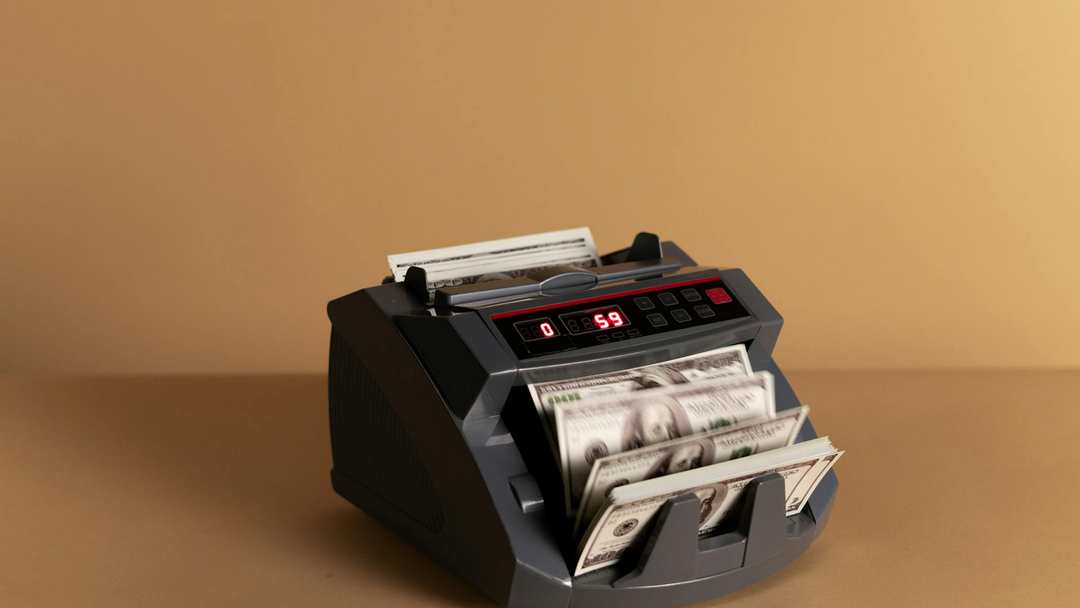

“It was designed to allow banks to provide legitimate banking services to legitimate businesses in those states,” Perlmutter said. “Credit cards, deposit accounts, payroll accounts, those kinds of things, so we don’t have this big giant pile of cash that then attracts crime.”

SAFER Banking Act – Links.

- Congress.gov – Bill S2860

- SAFER document section by section (PDF)

- SAFE Banking Act: Origins, History, Impact (2021)

- WIKI – SAFER Banking Act

From the Michigan Department of Attorney General

AG Nessel Joins Coalition in Urging Congress to Increase Access to Regulated Banking and Financial Services for State-Licensed Cannabis Businesses

September 28, 2023

LANSING – Michigan Attorney General Dana Nessel joined a coalition of 22 Attorneys General in submitting comments urging congressional leaders to advance the SAFER Banking Act of 2023 to lift banking restrictions that prevent state-licensed cannabis businesses from accessing a full range of regulated banking and financial services.

Despite the growing number of states that have legally authorized, regulated cannabis businesses, cannabis remains classified as an illegal substance under the federal Controlled Substances Act and certain federal banking statutes. Because cannabis remains classified as an illegal substance, banks providing services to state-licensed cannabis sales locations and related businesses are at risk for criminal and civil liability. This risk has significantly inhibited the ability of financial institutions to provide services to regulated cannabis licensees and leaves those businesses struggling to find financing. The lack of access to banking services creates both barriers to entry into the industry and instability for existing businesses. In addition, the current banking restrictions constrain state agencies’ efforts to collect taxes and conduct oversight. Further, as too many states have seen, when regulated businesses can only conduct business in cash, employees and customers are at greater risk of violent crime in pursuit of that cash.

“Legal cannabis businesses are still prevented from using traditional banking services available to all other legal businesses in the state,” Nessel said. “Without access to traditional banking the cannabis industry is left as a ripe target for criminals. Any legal business should have fair access to our banking institutions for the security of their own business and employees as well as public safety. It is important that Congress pass the SAFER Banking Act to update federal banking laws that have not caught up to the laws in many states.”

The attorneys general argue that passage of the SAFER Banking Act, which will enable regulated banks and financial institutions to provide services to state-licensed cannabis businesses, will enable economic growth, facilitate state oversight of tax obligations, and reduce the public safety risks associated with high-value, cash-based businesses. The SAFER Banking Act would establish a safe harbor for depository institutions providing a financial product or service to a regulated business in states that have regulations to ensure accountability in the cannabis industry.

The attorneys general argue that an effective safe harbor would bring billions of dollars into the banking sector, enabling law enforcement, federal, state, and local tax agencies, and cannabis regulators in thirty-eight states and several territories to more effectively monitor and ensure compliance of cannabis businesses and their transactions.

Joining the Maryland, Washington D.C., and Oklahoma–led comments are the attorneys general of Arizona, California, Colorado, Connecticut, Georgia, Hawaii, Illinois, Maine, Massachusetts, Nevada, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, Vermont, and Washington.

FAQs about the SAFER Banking Act

What is the SAFER Banking Act?

The Secure and Fair Enforcement Regulation Banking Act (SAFER Banking Act) is a bipartisan bill that would provide a safe harbor for financial institutions that provide banking services to cannabis-related businesses (CRBs) that operate in compliance with state law. The bill would also require the federal government to study the impact of cannabis legalization on the financial system.

What is a cannabis-related business (CRB)?

A cannabis-related business (CRB) is any business that engages in the cultivation, processing, sale, or distribution of cannabis or cannabis products. This includes dispensaries, medical marijuana dispensaries, growers, processors, and manufacturers.

Why is the SAFER Banking Act important?

Under current law, cannabis is still classified as a Schedule I controlled substance, which is the highest classification under the Controlled Substances Act. This means that banks and other financial institutions are at risk of being penalized by the federal government if they provide banking services to CRBs. As a result, many CRBs are forced to operate on a cash-only basis, which makes them more vulnerable to theft and other crimes.

The SAFER Banking Act would provide a safe harbor for financial institutions that provide banking services to CRBs that operate in compliance with state law. This would allow CRBs to access traditional banking services, such as deposit accounts, loans, and insurance. This would help CRBs to grow their businesses and create jobs.

Does the SAFER Banking Act make cannabis federally legal?

No, the SAFER Banking Act does not make cannabis federally legal. It simply provides a safe harbor for financial institutions that provide banking services to CRBs that operate in compliance with state law.

What are the benefits of the SAFER Banking Act?

The SAFER Banking Act would have a number of benefits, including:

- Increased safety and security for CRBs and their employees

- Reduced crime and violence

- Increased tax revenue for state and local governments

- Job creation and economic growth

- What is the status of the SAFER Banking Act?

The SAFER Banking Act was passed by the House of Representatives in September 2021. It is currently being considered by the Senate.

When is the SAFER Banking Act expected to be passed?

It is difficult to say when the SAFER Banking Act will be passed by the Senate. However, the bill has bipartisan support, and it is expected to be passed eventually.

More Posts

Domestic Violence Conviction Prohibits Gun Ownership

No Second Amendment Rights For YouIf you are charged with a crime you're part of the State of Michigan family now. Call us - Because you don't want to be a part of that family. Komorn Law (248) 357-2550A federal judge in Michigan has ruled that a man with a prior...

Update on Michigan’s Sick Time Act (Small Business Compliance)

Small Business Compliance Accrual Method: Employees accrue 1 hour of paid sick time forevery 30 hours worked, and unused paid sick time rolls over upto 72 hours, or 40 for a small business. Employers may limit theuse of earned sick time to 72 hours, or 40 for a small...

What Are Your Rights Before And After Arrest?

What are your rights before and after arrest?Generally, police require a search warrant to lawfully enter any private premises or to search electronic devices such as your phone or computer. If the police do not possess a search warrant, you are under no obligation to...

Michigan Probationers Allowed Medical Marijuana

Yea. We did that...What it is supposed to beOn February 11, 2021, the Michigan Court of Appeals ruled that judges cannot prohibit individuals on probation from using medical marijuana if they are registered patients under the Michigan Medical Marihuana Act (MMMA)....

Public Defenders in Michigan – Qualifications and What They Do

Note: This is what they are supposed to do. Whether they give a damn about you and the outcome is up to the individual attorneyWhat it is supposed to beIn Michigan, public defenders play a vital role in the criminal justice system by providing legal representation to...

New Michigan Laws Going Into Effect 2025

Making laws as fast as possible. Look over here...Not over there.Some of Michigan's new laws in 2025 include minimum wage increases, paid sick time, and automatic voter registration. Minimum wage The minimum wage in Michigan increased to $10.56 per hour on January 1,...

Whitmer’s $3B plan to fix Michigan’s roads calls for more taxes

Same Thing - Different DayWhitmer's $3B plan to fix Michigan roads calls for more corporate, marijuana taxes, taxes at the pump and you can just imagine the ones you don't know about.Michigan Governor Gretchen Whitmer has introduced a comprehensive three billion...

Making terrorist threat or false report of terrorism is free speech?

Making terrorist threat or false report of terrorism is free speech?The US Constitution and Michigan Constitution prohibit the government from making laws that abridge the freedom of speech Summary In the case of People of the State of Michigan v. Michael Joseph...

Washtenaw Prosecutor will not file any criminal charges on you

Washtenaw County Policy Directive 2025-01POLICY REGARDING QUANTITATIVE DRUG CHECKING Introduction The overdose crisis in America has persisted for decades, resulting in profound loss and suffering across the nation. Since 1999, opioid overdoses have tragically taken...

Qualifying for a Public Defender in Michigan

In Michigan, individuals charged with a crime have the constitutional right to legal representation.In Michigan, individuals charged with a crime have the constitutional right to legal representation. For those unable to afford a private attorney, the state provides...