October 2, 2023 – The Senate Banking Committee’s historic vote propels the SAFER Banking Act to the Senate floor, marking a significant milestone. The bill must now navigate the Senate and the House of Representatives before reaching President Biden’s desk. Cannabis dispensaries have embraced this legislation, expressing their admiration of course.

Earl Blumenauer (D-OR) and Dave Joyce (R-OH) who introduced SAFE Banking the House, released the following statement on the passage of the SAFER Banking Act in the Senate Committee on Banking, Housing, and Urban Affairs:

“This legislation will save lives and livelihoods. The overwhelming majority of Americans live in a state where cannabis is legal in some form. It is common sense and an urgent matter of public safety that these legitimate cannabis businesses have access to standard banking services.”

Former Colorado Democratic Congressman Ed Perlmutter has been pushing for the Secure and Fair Enforcement Regulation Banking Act, or SAFER Banking Act, for a decade now.

“It was designed to allow banks to provide legitimate banking services to legitimate businesses in those states,” Perlmutter said. “Credit cards, deposit accounts, payroll accounts, those kinds of things, so we don’t have this big giant pile of cash that then attracts crime.”

SAFER Banking Act – Links.

- Congress.gov – Bill S2860

- SAFER document section by section (PDF)

- SAFE Banking Act: Origins, History, Impact (2021)

- WIKI – SAFER Banking Act

From the Michigan Department of Attorney General

AG Nessel Joins Coalition in Urging Congress to Increase Access to Regulated Banking and Financial Services for State-Licensed Cannabis Businesses

September 28, 2023

LANSING – Michigan Attorney General Dana Nessel joined a coalition of 22 Attorneys General in submitting comments urging congressional leaders to advance the SAFER Banking Act of 2023 to lift banking restrictions that prevent state-licensed cannabis businesses from accessing a full range of regulated banking and financial services.

Despite the growing number of states that have legally authorized, regulated cannabis businesses, cannabis remains classified as an illegal substance under the federal Controlled Substances Act and certain federal banking statutes. Because cannabis remains classified as an illegal substance, banks providing services to state-licensed cannabis sales locations and related businesses are at risk for criminal and civil liability. This risk has significantly inhibited the ability of financial institutions to provide services to regulated cannabis licensees and leaves those businesses struggling to find financing. The lack of access to banking services creates both barriers to entry into the industry and instability for existing businesses. In addition, the current banking restrictions constrain state agencies’ efforts to collect taxes and conduct oversight. Further, as too many states have seen, when regulated businesses can only conduct business in cash, employees and customers are at greater risk of violent crime in pursuit of that cash.

“Legal cannabis businesses are still prevented from using traditional banking services available to all other legal businesses in the state,” Nessel said. “Without access to traditional banking the cannabis industry is left as a ripe target for criminals. Any legal business should have fair access to our banking institutions for the security of their own business and employees as well as public safety. It is important that Congress pass the SAFER Banking Act to update federal banking laws that have not caught up to the laws in many states.”

The attorneys general argue that passage of the SAFER Banking Act, which will enable regulated banks and financial institutions to provide services to state-licensed cannabis businesses, will enable economic growth, facilitate state oversight of tax obligations, and reduce the public safety risks associated with high-value, cash-based businesses. The SAFER Banking Act would establish a safe harbor for depository institutions providing a financial product or service to a regulated business in states that have regulations to ensure accountability in the cannabis industry.

The attorneys general argue that an effective safe harbor would bring billions of dollars into the banking sector, enabling law enforcement, federal, state, and local tax agencies, and cannabis regulators in thirty-eight states and several territories to more effectively monitor and ensure compliance of cannabis businesses and their transactions.

Joining the Maryland, Washington D.C., and Oklahoma–led comments are the attorneys general of Arizona, California, Colorado, Connecticut, Georgia, Hawaii, Illinois, Maine, Massachusetts, Nevada, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, Vermont, and Washington.

FAQs about the SAFER Banking Act

What is the SAFER Banking Act?

The Secure and Fair Enforcement Regulation Banking Act (SAFER Banking Act) is a bipartisan bill that would provide a safe harbor for financial institutions that provide banking services to cannabis-related businesses (CRBs) that operate in compliance with state law. The bill would also require the federal government to study the impact of cannabis legalization on the financial system.

What is a cannabis-related business (CRB)?

A cannabis-related business (CRB) is any business that engages in the cultivation, processing, sale, or distribution of cannabis or cannabis products. This includes dispensaries, medical marijuana dispensaries, growers, processors, and manufacturers.

Why is the SAFER Banking Act important?

Under current law, cannabis is still classified as a Schedule I controlled substance, which is the highest classification under the Controlled Substances Act. This means that banks and other financial institutions are at risk of being penalized by the federal government if they provide banking services to CRBs. As a result, many CRBs are forced to operate on a cash-only basis, which makes them more vulnerable to theft and other crimes.

The SAFER Banking Act would provide a safe harbor for financial institutions that provide banking services to CRBs that operate in compliance with state law. This would allow CRBs to access traditional banking services, such as deposit accounts, loans, and insurance. This would help CRBs to grow their businesses and create jobs.

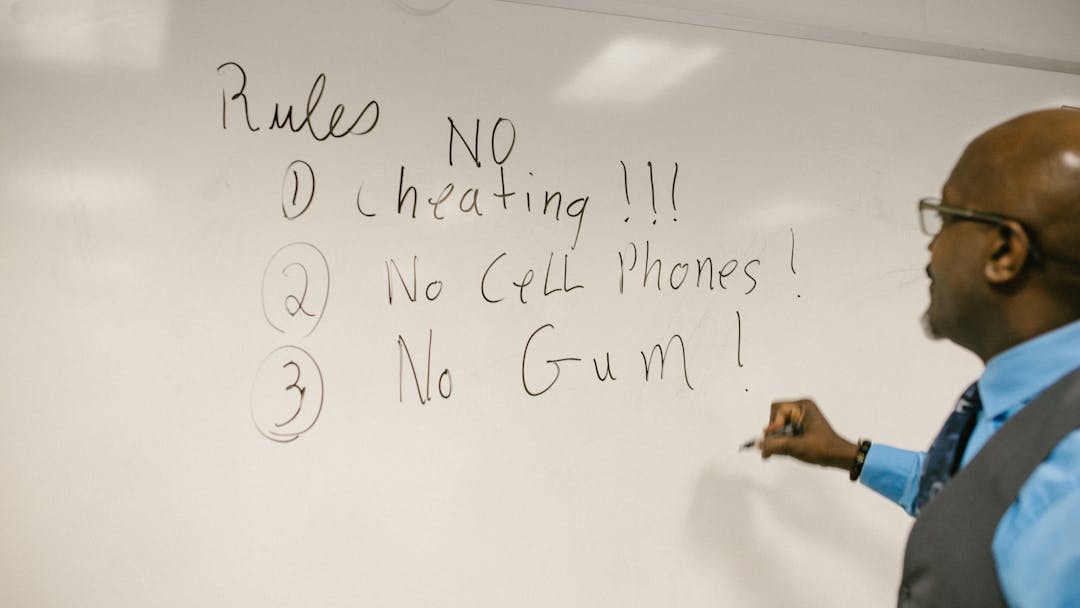

Does the SAFER Banking Act make cannabis federally legal?

No, the SAFER Banking Act does not make cannabis federally legal. It simply provides a safe harbor for financial institutions that provide banking services to CRBs that operate in compliance with state law.

What are the benefits of the SAFER Banking Act?

The SAFER Banking Act would have a number of benefits, including:

- Increased safety and security for CRBs and their employees

- Reduced crime and violence

- Increased tax revenue for state and local governments

- Job creation and economic growth

- What is the status of the SAFER Banking Act?

The SAFER Banking Act was passed by the House of Representatives in September 2021. It is currently being considered by the Senate.

When is the SAFER Banking Act expected to be passed?

It is difficult to say when the SAFER Banking Act will be passed by the Senate. However, the bill has bipartisan support, and it is expected to be passed eventually.

More Posts

Dead goats lead Michigan deputies to illegal marijuana grow

Deceased goats pointed Calhoun County deputies in the direction of a much larger investigation over the weekend. Deputies had been called to Cooper Avenue near Burton Street Saturday for an animal welfare complaint, and found four dead goats at the back of the...

How DUI Charges Impact Your Child’s Future

In Michigan driving is considered a privilege. with this privilege comes immense responsibility, especially when it comes to driving under the influence (DUI) as well as other responsibilities. The consequences of youth DUI extend far beyond the immediate legal...

Over 650 investigative cases affected by DNA analyst’s data manipulation

652 cases between 2008 and 2023 are affected. Cases before that are still under review. A former DNA analyst with the Colorado Bureau of Investigation (CBI) manipulated DNA results and "cut corners" – and as a result, all of her work at the agency over nearly 30 years...

Michigan wants to study marijuana’s health benefits

MICHIGAN WANTS TO STUDY MARIJUANA’S HEALTH BENEFITSWhen Michigan voters approved recreational marijuana six years ago, they also allocated cannabis tax revenue for research into the health benefits of the drug specifically for military veterans. In a remarkable...

Smoking cannabis associated with increased risk of heart attack, stroke

NIH-funded observational study shows risk grows sharply with more frequent use.Smoking, vaping, or consuming marijuana has been found to be associated with a significantly heightened risk of heart attack and stroke, regardless of a person's pre-existing heart...

Rescheduling Marijuana Would Be a Threat to Public Health

Kevin Sabet of Smart Approaches to Marijuana says policy makers need to learn from their mistakes with hemp when considering marijuana rescheduling. It’s rare for policymakers to get a preview of the consequences of pending policies, but the descheduling of...

$87 million in adult-use marijuana payments to be sent out across Michigan

The Michigan Department of Treasury today announced that more than $87 million is being distributed among 269 municipalities and counties as a part of the Michigan Regulation and Taxation of Marijuana Act. Over the next few days, 99 cities, 30 villages, 69 townships...

Meet MiChap

Climate and Health Adaptation ProgramYou must save yourself from yourself.Meet MICHAPOur Vision: Michigan's public health system fosters equitable health and wellbeing as it adapts to the current and future impacts of climate change. Our Mission: The Michigan Climate...

Understanding the Rule of Completeness in Michigan Courts

Understanding the Rule of Completeness in Michigan Courts: MRE 106In the pursuit of truth and ensuring fairness during legal proceedings, the Michigan Rules of Evidence (MRE) play a crucial role. One particular rule, MRE 106 (Completeness), safeguards against...

Police seize 4,000 marijuana plants, processed weed worth $6.3M

HIGHLAND PARK, MI - Feb. 24, 2024 Michigan State Police say they busted a “large-scale illicit market” marijuana grow operation in metro Detroit. After a months long investigation, the Michigan State Police Marijuana & Tobacco Investigation Section conducted a...