Would enforcing payment and accepting money from a federally illegal business cause you to be caught up in RICO, CCE and conspiracy charges that would put you away for decades? For you yes – For the government a big NO.

Multistate marijuana company Trulieve Cannabis Corp. is currently seeking a federal tax refund amounting to $143 million. The company firmly maintains that it does not owe the taxes it had diligently paid over a span of three years.

“This determination is supported by legal interpretations that challenge the company’s tax liability under Section 280E of the Internal Revenue Code,” Florida-based Trulieve announced through a recent news release.

Section 280E poses a significant obstacle for state-legal marijuana companies, as it prohibits them from deducting their standard business expenses. Consequently, these companies are burdened with substantially increased tax bills.

26 U.S. Code § 280E – Expenditures in connection with the illegal sale of drugs

No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted.

More Posts

How a sex toy put spotlight on Michigan civil asset forfeiture laws targeted for reform

The headlines read... "How a sex toy put national spotlight on Michigan civil asset forfeiture laws targeted for reform" "State Legislators Reconsider Forfeiture Laws That Turn Cops Into Robbers" "Why Take My Vibrator?" Cops Legally Rob "every Belonging"...

Reform Today’s Forfeiture Laws

Everyday, I get calls to my office from medical marijuana patients and caregivers who have been raided or pulled over by police. Often times, these individuals are not arrested, and little if any paperwork is left behind by the various Narcotics Enforcement Teams....

KOMORN LAW NEWSLETTER ISSUE #1 May 2015

The Michigan Legal Advisor News Letters. Read the current newsletter from Michigan's #1 Medical Marijuana Defense Attorney Michael Komorn. KOMORN LAW NEWSLETTER ISSUE #1 May 2015 Michael Komorn is recognized as a leading expert on the Michigan Medical...

Attorney Michael Komorn Lectures Students at the U of M Law School

I wanted to give a huge thanks to University of Michigan Law School Professors Howard Bromberg, Mark Osbeck and Law School class. This past Thursday I had the honor of being asked to speak about my favorite topics, the Michigan Medical Marihuana Act and the practice...

Jury Selection In Marihuana Cases

A jury trial is fundamental to our democratic system of government. Every American citizen should embrace this responsibility by participating, and ensure justice prevails. by Michael Komorn I just picked a jury in a marihuana case, there were several perspective...

Planet Green Trees Radio Episode 149-MSC People v. Koon

The best resource for everything related to Michigan medical marijuana with your host Attorney Michael Komorn. Live every Thursday evening from 8 -10 pm eastern time. By Michael Komorn The Michigan Supreme Court issued a unanimous opinion making a finding that...

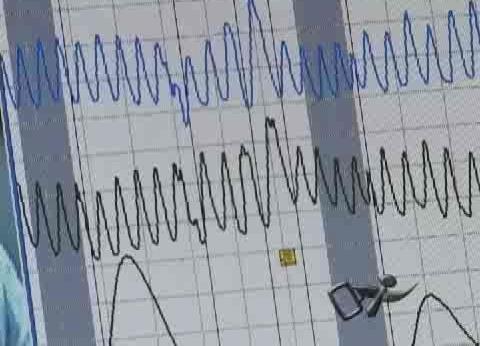

Polygraphs Proven Unreliable, Used for Police Intimidation

Polygraphs are widely recognized as unreliable yet police still use them to elicit confessions. By Michael Komorn Many states don’t allow polygraph test to be admitted in court because they are unreliable. Their lack of reliability is widely recognized by criminal...

Arrests for DUI’s on the Rise

By Michael Komorn Arrests for DUI’s have been on the rise across Michigan. This trend could drastically increase as The National Transportation Safety Board (NTSB) has called on state authorities to reduce the legal limit to 0.05 percent. Currently, all 50 U.S. states...

US District Court Judge rules police cannot enter a car without a warrant to facilitate a drug dog sniff

Federal Judge Applies GPS Ruling To Drug Dog Traffic Stop By Michael Komorn Last week, a judge with the US District Court for the Southern District of West Virginia applied the precedent to the common police practice of “permeation” where a police officer enters a...

Drug Checkpoints: Unconstitutional

By Michael Komorn The Supreme Court ruled in City of Indianapolis V. Edmund that drug check points are unconstitutional. So what happens when you see one on the highway? Keep calm and carry on. Police, especially in the Mid-west, have been using drug check points as a...