Would enforcing payment and accepting money from a federally illegal business cause you to be caught up in RICO, CCE and conspiracy charges that would put you away for decades? For you yes – For the government a big NO.

Multistate marijuana company Trulieve Cannabis Corp. is currently seeking a federal tax refund amounting to $143 million. The company firmly maintains that it does not owe the taxes it had diligently paid over a span of three years.

“This determination is supported by legal interpretations that challenge the company’s tax liability under Section 280E of the Internal Revenue Code,” Florida-based Trulieve announced through a recent news release.

Section 280E poses a significant obstacle for state-legal marijuana companies, as it prohibits them from deducting their standard business expenses. Consequently, these companies are burdened with substantially increased tax bills.

26 U.S. Code § 280E – Expenditures in connection with the illegal sale of drugs

No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted.

More Posts

Understanding Domestic Violence Laws in Michigan

Understanding Domestic Violence Laws in MichiganDomestic violence is a serious issue that can affect anyone, regardless of age, income, or background. If you are experiencing domestic violence in Michigan, it's important to know your rights and the laws that protect...

Macomb Prosecutor issues first charges under new safe storage law

Understanding Domestic Violence Laws in MichiganMacomb County Prosecutor Peter Lucido has filed the first charges under Michigan's new safe storage law following a critical accident in Warren. An 8-year-old boy allegedly accessed an unsecured firearm and shot himself...

Marijuana grow busted as feds investigations trend in more states

The DEA is investigating international criminal organizations that are operating illegal marijuana grows in about 20 states, including Maine.The significant electricity usage in a residence, its windows concealed with cardboard, and the scent of marijuana caught the...

A visit with a kick

POW - Right in the Kisser. Businesses watch out for the lawA Pennsylvania-based convenience store chain was hit with a lawsuit by the Biden administration at the same time the president stopped by one of their locations on the campaign trail. Sheetz is being accused...

Woman tried to board flight with 56 pounds of marijuana

Woman allowed airport police to check her luggage, had name tag on bags, according to reportsBefore a 21-year-old Memphis woman could board an United Airlines flight, Memphis International Airport Police found 56 pounds of marijuana in her luggage, according to...

Oregon governor signs a bill recriminalizing drug possession

Oregon governor signs a bill recriminalizing drug possession into lawOn April 1, 2024, Oregon Governor Tina Kotek signed House Bill 4002 into law, effectively recriminalizing the possession of small amounts of certain controlled substances. This legislation marks a...

John Sinclair, the inspiration for Ann Arbor’s Hash Bash, dead at 82

John Sinclair, the poet whose imprisonment for marijuana inspired the start of Ann Arbor’s long-running annual Hash Bash in the 1970s, has died. He was 82.Sinclair's passing occurred on Tuesday, April 2, 2024, at a Detroit hospital, merely four days prior to his...

Disciplining Student’s Speech Violates First Amendment

You go girl!!!A public high school was found to have violated the First Amendment when it suspended a student from her cheerleading team for using profane speech off campus. Mahanoy Area Sch Dist v BL, No 20-255, ___ US ___ (June 23, 2021). The U.S. Supreme Court has...

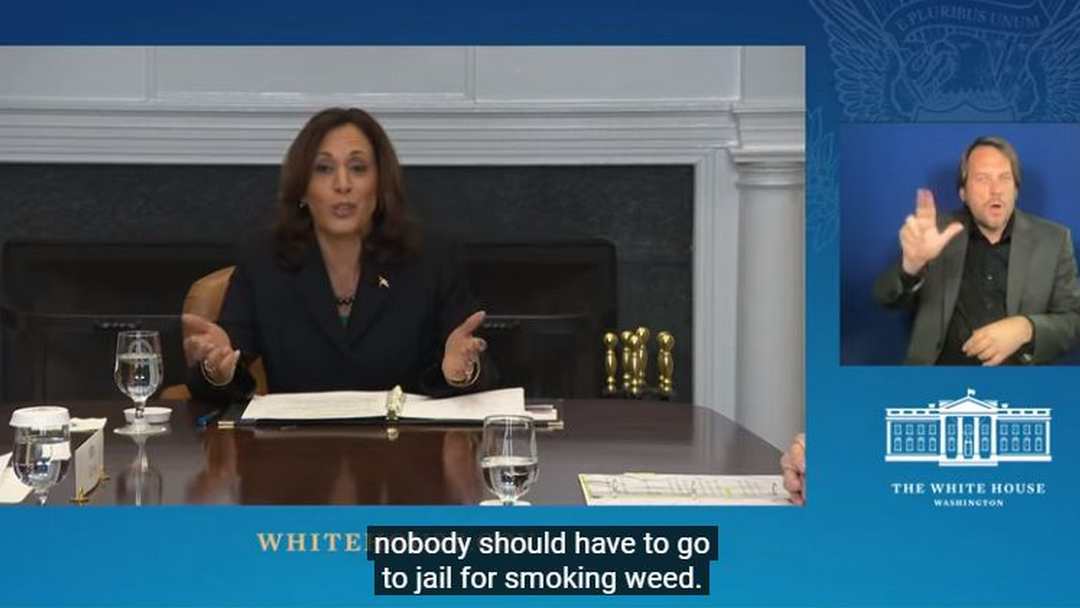

Marijuana reform advocates demand apology from Kamala Harris

So SorryMarijuana reform advocates demand an apology from Kamala Harris for locking up pot smokers and slam her 'political hypocrisy' for now saying no one should 'go to jail for smoking weed!'Marijuana reform advocates are urging Vice President Kamala Harris to issue...

Federal Agency Smack Down on a Michigan Credit Union’s Cannabis Banking

Apple to ApplesAn independent federal agency has recently cited a Michigan credit union for non-compliance with regulations regarding banking services for the marijuana industry. Consequently, the financial institution has been directed to halt the opening of new...