In 2023 according to sources on the internet the Michigan lottery made 46 million , liquor taxes made $31.5 billion this year, a slight increase from previous projections but close to $400 million less than the previous year. Marijuana about 3 billion.

Michigan’s legal marijuana retailers experienced remarkable success in 2023, generating an impressive $3 billion in cannabis sales. Notably, the sales soared even higher in December, surpassing all previous records.

Licensed businesses achieved a remarkable milestone last month, generating an impressive $279.9 million in total sales, as revealed by the latest state sales data. This outstanding performance sets a new record, surpassing the previous highest monthly earnings of $276.7 million, which were accomplished in July of the previous year.

All recorded sales for 2023, including both adult-use and medical purchases, reached a staggering $3,057,161,285.85, as reported by Michigan’s Cannabis Regulatory Agency (CRA). This figure surpasses the previous year’s total of $2.29 billion by approximately one-third, highlighting the remarkable growth within the industry.

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

RESTORE YOUR SECOND AMENDMENT RIGHTS

RESTORE YOUR PROFESSIONAL LICENSE

RESTORE YOUR DRIVER LICENSE

RESTORE YOUR PAST (Expungements)

Call our Office for a free case evaluation

Komorn Law (248) 357-2550

Detroit casinos report $116.2M in December revenue, $1.237B for year

DETROIT, Jan. 9, 2024 — The three Detroit casinos reported $116.2 million in monthly aggregate revenue (AGR) for the month of December 2023, of which $111.4 million was generated from table games and slots, and $4.8 million from retail sports betting.

The December market shares were:

MGM, 44%

MotorCity, 32%

Hollywood Casino at Greektown, 24%

Monthly Table Games, Slot Revenue, and Taxes

December 2023 table games and slot revenue increased 2.9% when compared to December 2022 revenue. December’s monthly revenue was also 46.6% higher than November 2023. From Jan. 1 through Dec. 31, the Detroit casinos’ table games and slots revenue decreased by 2.7% compared to the same period last year.

The casinos’ monthly gaming revenue results were mixed compared to December 2022:

MGM, down 0.7% to $50.6 million

MotorCity, up by 5.1% to $34.7 million

Hollywood Casino at Greektown, up by 7.5% to $26.1 million

In December 2023, the three Detroit casinos paid $9.0 million in gaming taxes to the State of Michigan. They paid $8.8 million for the same month last year. The casinos also reported submitting $13.8 million in wagering taxes and development agreement payments to the City of Detroit in December.

Quarterly Table Games, Slot Revenue, and Taxes

For the fourth quarter of 2023 that ended Dec. 31, aggregate revenue was down for all three Detroit casinos by 12.9% compared to the same period last year. Quarterly gaming revenue for the casinos was:

MGM: $118.6 million

MotorCity: $84.4 million

Hollywood Casino at Greektown: $66.2 million

Compared to the fourth quarter of 2022, MGM, MotorCity, and Hollywood Casino at Greektown were down by 17.7%, 11.6%, and 4.7%, respectively. The three casinos paid $21.8 million in gaming taxes to the state in the fourth quarter of 2023, compared to $25.0 million in the same quarter last year.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $30.4 million in total retail sports betting handle, and total gross receipts were $4.8 million for the month of December. Retail sports betting qualified adjusted gross receipts (QAGR) in December 2023 were up by $3.1 million when compared to December 2022. Compared to November 2023, December QAGR increased 54.9%.

December QAGR by casino was:

MGM: $291,171

MotorCity: $2.3 million

Hollywood Casino at Greektown: $2.2 million

During December, the casinos paid $180,822 in gaming taxes to the state and reported submitting $221,005 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Annual Revenue for Table Games, Slots, and Retail Sports Betting

The total yearly aggregate revenue of $1.237 billion — a slight decrease of 3.1% compared to last year — by the three Detroit casinos for slots, table games, and retail sports betting was generated by:

Slots: $984.1 million (80%)

Table games: $238.7 million (19%)

Retail sports betting: $14.0 million (1%)

The casinos’ market shares for the year were:

MGM, 46%

MotorCity, 31%

Hollywood Casino at Greektown, 23%

Compared to 2022, slots and table games yearly gaming revenue for the three casinos were as follows:

MGM, down by 6.0% to $564.0 million

MotorCity, down by 5.8% to $373.6 million

Hollywood Casino at Greektown, up by 9.5% to $285.2 million

Aggregate retail sports betting qualified adjusted gross receipts (QAGR) for 2023 was down by 25.7% to $14.0 million compared to last year, with MGM totaling $2.3 million, MotorCity totaling $5.0 million, and Hollywood Casino at Greektown totaling $6.7 million.

In 2023, the three Detroit casinos paid the state $99.0 million in wagering taxes for slots and table games, and $528,314 in wagering taxes for retail sports betting. In 2022, they had paid $101.8 million and $711,087 for each, respectively.

Fantasy Contests

For November, fantasy contest operators reported total adjusted revenues of $1.8 million and paid taxes of $149,915.

From Jan. 1 through Nov. 30, fantasy contest operators reported $21.3 million in aggregate fantasy contest adjusted revenues and paid $1.8 million in taxes.

Gambling in any form is for entertainment purposes only. If someone has a gambling problem, please call the state’s 24-hour, toll-free helpline at 1-800-270-7117 or the MGCB’s responsible gaming section at 1-888-223-3044. Visit the Responsible Gaming page of the MGCB website for information on self-exclusion programs including the Disassociated Persons List and the Internet Gaming and Sports Betting Responsible Gaming Database, and DontRegretTheBet.org for additional tools to game responsibly.

The Michigan Gaming Control Board shall ensure the conduct of fair and honest gaming to protect the interests of the citizens of the state of Michigan. Learn more at Michigan.gov/MGCB.

How is the money spent?

Komorn Law – Federal Courts and All Michigan Courts

More Posts

Smell of Marijuana is Not Enough to Search Your Vehicle or is it?

The Smell of Marijuana and the Court of Appeals Body camera footage is an invaluable resource for courts facing suppression motions, but it rarely serves as a stand-alone source of information about a warrantless search or seizure. Here, the trial court was hamstrung...

Commission Votes For Retroactive Sentencing

U.S. SENTENCING COMMISSION VOTES TO ALLOW RETROACTIVE SENTENCE REDUCTIONS AND ANNOUNCES ITS NEXT SET OF POLICY PRIORITIESVote Authorizes Judges to Reduce Sentences for Eligible Incarcerated Persons Beginning February 1, 2024 Should Guidelines Become...

THC Detection in Blood: Challenges and Implications

THC Detection in Blood: Challenges and Implications When it comes to enforcing drugged driving laws, police and employers face a unique challenge with marijuana. Unlike alcohol, which is metabolized and eliminated relatively quickly, THC, the psychoactive compound in...

Feds New Sentencing Guidelines for Past Cannabis Convictions

The federal U.S. Sentencing Commission (USSC) has approved a revised amendment to sentencing guidelines, advising judges to adopt a more lenient approach towards prior marijuana possession offenses. Members of the commission voted to approve a range of amendments to...

THC Detection in Blood: A Comprehensive Review

THC Detection in Blood: A Comprehensive Review Tetrahydrocannabinol (THC), the main psychoactive compound in marijuana, can remain detectable in the blood for several days or even weeks after use. This is due to the fact that THC is highly fat-soluble, meaning that it...

It’s not hard to be accused of being a Menace in Michigan

“You are a menace, you’re talking louder than me, you don’t agree with me and now you're pointing at me with gun fingers. I feel threatened! I’m calling the police”. All over a minor disagreement - probably about paper or plastic. Police arrive and can only do what...

Skymint acquired out of receivership

Tropics LP, under a new entity called Skymint Acquisition Co., acquired the assets of Green Peak Industries, doing business as Skymint, for $109.4 million. Nuff saidPlease note that cannabis at the time of this post being published is still a controlled substance...

Trulieve seeks $143M federal refund for 280E taxes

Would enforcing payment and accepting money from a federally illegal business cause you to be caught up in RICO, CCE and conspiracy charges that would put you away for decades? For you yes - For the government a big NO.Multistate marijuana company Trulieve Cannabis...

Feds Clarify Doctor Prescribed Medical Cannabis Is No Excuse

The revised federal workplace drug testing guidelines, issued by the Substance Abuse and Mental Health Services Administration (SAMHSA), Department of Health and Human Services (HHS), are intended to provide clarity. These guidelines emphasize that individuals who use...

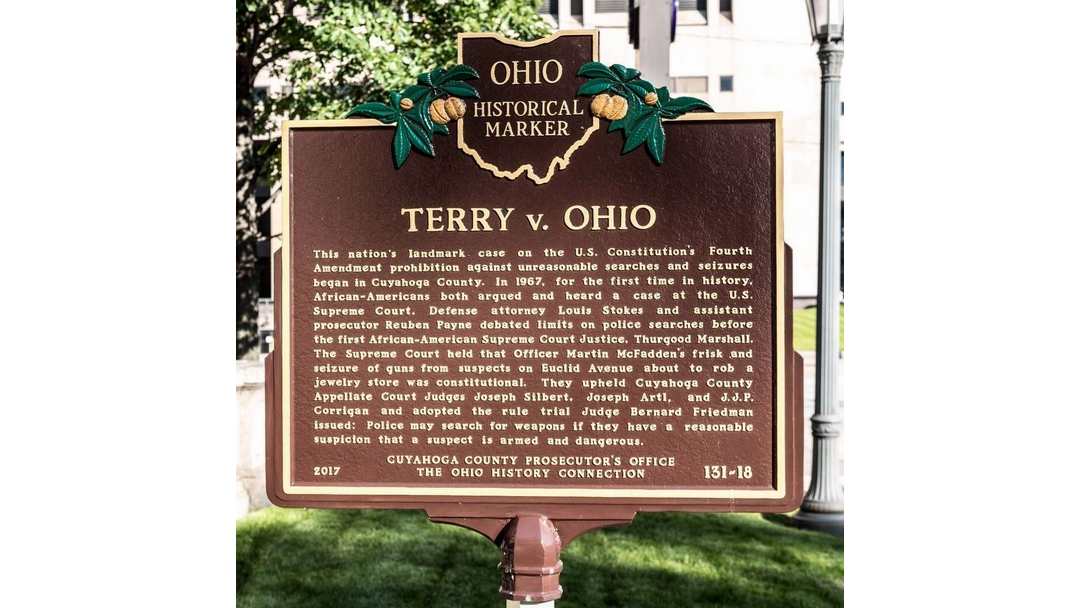

Stop and Frisk – Terry v. Ohio

Terry v. Ohio (1968)Background On October 31, 1963 while conducting his regular patrol in downtown Cleveland, seasoned Cleveland Police detective Martin McFadden, who brought 39 years of law enforcement experience to the job, observed three men behaving suspiciously...